Title loans for classic cars provide immediate funding for car enthusiasts, secured by their vehicle's title. Lenders assess factors like make, model, age, and condition to determine a fair loan amount, while refinancing options allow adjustments to repayment terms. Both owners and lenders must navigate regulations to ensure protection, with local laws potentially requiring maintenance records and insurance proof. Using the car's title as collateral, this solution offers quick cash access without parting with the prized possession permanently.

“Unleashing the Power of a Title Loan for Your Classic Car: A Comprehensive Guide

Are you a proud owner of a vintage vehicle? If you’re looking to secure funding for your beloved classic car, a title loan could be an option. This guide explores the ins and outs of ‘Title Loans for Classic Cars’. We delve into the process, dispel myths, and navigate the restrictions and regulations surrounding these loans.

From understanding the basics to tips for getting approved, this article is your go-to resource for making informed decisions about financing your classic car.”

- Understanding Title Loans for Classic Cars

- Restrictions and Regulations: What You Need to Know

- Navigating the Process: Getting a Loan for Your Beloved Classic

Understanding Title Loans for Classic Cars

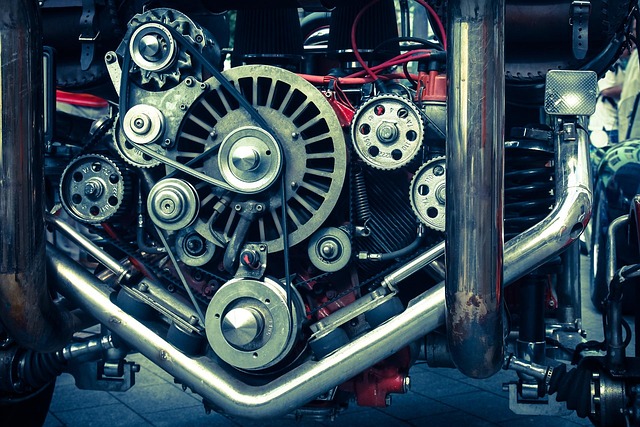

Title loans for classic cars are a unique financial tool that allows car enthusiasts to access capital using their vintage vehicles as collateral. These loans, also known as secured loans, offer an alternative financing option for those who own and cherish classic automobiles but may require immediate funding for various reasons. Unlike traditional loan types, title loans focus on the vehicle’s value rather than the borrower’s creditworthiness, making them accessible to a broader range of individuals.

When considering a title loan for your classic car, understanding the loan requirements is crucial. Lenders will assess factors such as the vehicle’s make, model, year, condition, and market value. While this may seem restrictive, it ensures that the loaned amount aligns with the asset’s worth, providing both security for the lender and peace of mind for the borrower. Furthermore, loan refinancing options can be explored if circumstances change, allowing owners to adjust repayment terms and potentially lower interest rates.

Restrictions and Regulations: What You Need to Know

When considering a title loan for classic cars, it’s crucial to understand that these loans come with their own set of restrictions and regulations. Unlike traditional personal loans, which often have lenient requirements, title loans on classic vehicles are subject to specific guidelines aimed at protecting both lenders and borrowers. One of the primary factors is the vehicle’s value; lenders will assess its condition, rarity, and market demand to determine a fair loan-to-value ratio. This ensures that the loan amount aligns with the car’s actual worth, providing a more secure financial solution for classic car owners.

Additionally, regulations may vary by location, with some areas having stricter rules on Fort Worth Loans (or similar) for classic cars. For instance, lenders might require detailed maintenance records and proof of insurance to mitigate risks associated with older vehicles. Utilizing vehicle collateral in this manner can be an attractive financial option for car enthusiasts who need quick access to cash without parting with their beloved classics permanently.

Navigating the Process: Getting a Loan for Your Beloved Classic

Navigating the process of obtaining a title loan for classic cars can seem daunting, but with some preparation and knowledge, it can be a smooth and rewarding experience for car enthusiasts. The first step is to understand the unique requirements of such loans. Unlike traditional car loans, title loans use the vehicle’s title as collateral, offering a faster and more accessible option for those in need of quick funding. This alternative financing method is particularly appealing to classic car owners who may struggle to find conventional lenders willing to take on these valuable yet potentially less liquid assets.

When applying for a title loan, borrowers will need to provide proof of ownership, vehicle registration, and identification. Lenders will then assess the car’s value, taking into account its make, model, age, and condition. The approval process involves verifying the information provided and ensuring the vehicle is in good working order. Once approved, the lender will disburse the loan funds, allowing you to access the necessary cash advance for your beloved classic car. Remember, while this option provides quick access to capital, it’s crucial to have a clear understanding of the loan requirements and terms to ensure a smooth loan payoff experience.

While title loans for classic cars can provide much-needed funding for their preservation and restoration, it’s crucial to understand the restrictions and regulations in place. These laws are designed to protect both lenders and owners, ensuring fair practices. By navigating the process wisely, classic car enthusiasts can access financial support without compromising the value or integrity of their beloved vehicles. Remember, responsible borrowing and informed decisions are key to enjoying your classic car for years to come while maintaining its historical significance.