Title loans for classic cars offer a specialized financing option in Houston and Dallas, providing swift cash for repairs while preserving vintage vehicles as collateral. This accessible alternative caters to limited banking options of car enthusiasts, offering debt consolidation with potentially lower rates and simplifying payments, all while keeping the classic car secure. Strategic planning involving vehicle appreciation can reduce debt; timely repayments ensure peace of mind.

Title loans for classic cars offer a unique financing solution for car enthusiasts. If you own a cherished vintage vehicle and need funds for restoration or upgrades, borrowing against its value can be a smart move. This article explores the ins and outs of title loans in this niche market, highlighting benefits like quick access to capital and flexible repayment terms. We’ll guide you through the process, offering strategies to ensure a seamless experience and helping you make informed decisions regarding your classic car’s financial future.

- Understanding Title Loans for Classic Cars

- Benefits of Borrowing Against Your Classic Vehicle

- Smart Strategies for Repaying Your Loan

Understanding Title Loans for Classic Cars

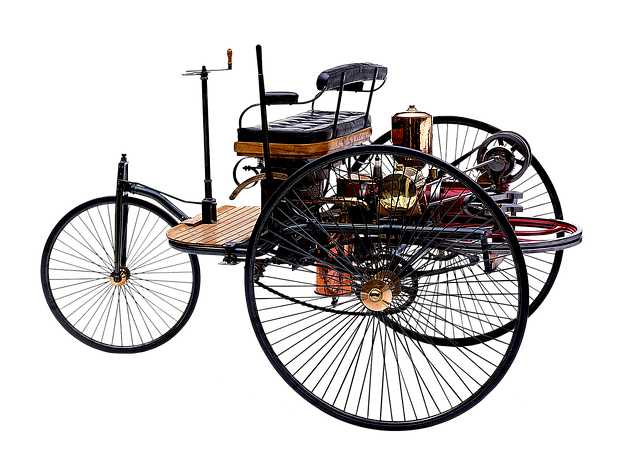

Title loans for classic cars offer a unique financial solution for car enthusiasts who want to preserve and protect their cherished vehicles. This alternative financing method allows owners to borrow money against the value of their classic cars, providing fast cash when needed without sacrificing the beloved vehicle. It’s particularly beneficial in cities like Houston or Dallas, where the market for these vintage autos can be strong.

These loans are secured by the title of the car, hence the term “title loan.” The process is relatively straightforward compared to traditional loan options. Lenders assess the car’s value and offer a loan amount based on its condition and market price. This accessibility makes it an attractive option for classic car owners who may have limited banking options or require swift financial support for unexpected repairs or other expenses. Whether you’re in Houston or Dallas, understanding this type of loan can empower car enthusiasts to make informed decisions regarding their classic vehicles’ financial future.

Benefits of Borrowing Against Your Classic Vehicle

Borrowing against your classic vehicle through a title loan can offer several advantages for car enthusiasts who want to access funds while keeping their cherished possessions. One of the key benefits is the flexibility it provides in terms of funding options. This alternative financing method allows owners to use their classic cars as collateral, providing quick and easy access to cash without the need for traditional bank loans or credit lines. It’s particularly appealing for those who possess valuable collectibles and want to preserve them while raising capital for various purposes.

Additionally, a title loan for classic cars can serve as an efficient debt consolidation strategy. If you have multiple debts with varying interest rates, rolling them into a single title loan might simplify your financial situation. This approach could potentially lower your overall monthly payments and save on interest charges, making it a practical solution for managing outstanding loans while ensuring your classic car remains secure as collateral.

Smart Strategies for Repaying Your Loan

When it comes to repaying a Title loan for classic cars, strategic planning can make all the difference. One effective approach is to incorporate your vehicle’s value into your repayment strategy. Since classic cars often appreciate over time, consider using any gains in value as partial repayment. This can reduce the overall debt and even extend the life of your loan. For instance, if you initially borrowed funds for a restoration project, monitor the market trends and sell or auction off the fully restored car to offset the loan balance.

Additionally, exploring options like direct deposit for repayments ensures timely payments. Many lenders offer automated payment plans that debit your bank account on specific dates, eliminating the risk of late fees. If managing multiple debts is a concern, a Title loan for classic cars can facilitate debt consolidation. By combining various loans into one with a potentially lower interest rate, you simplify repayment and may save money in the long run. Always ensure proper vehicle inspection during the loan process to determine accurate funding amounts and protect yourself from unforeseen issues.

Title loans for classic cars offer a unique and flexible financing option for car enthusiasts. By understanding these loans and employing smart repayment strategies, you can borrow against your beloved vintage vehicle without sacrificing its value. This approach allows you to access the funds needed for restoration projects, upgrades, or even daily driving, all while preserving your classic car’s legacy.