Classic car owners struggling with funding can access immediate financial support through Title Loans for Classic Cars. By using their vehicle's appraised worth as collateral, enthusiasts can borrow based on their car's condition, regardless of credit history. The online application process is simple and efficient, offering fast cash for restoration or special purchases. However, higher interest rates and late repayment fees/repossession risks require responsible financial management.

Looking to unlock cash hidden within your classic car? Discover the power of title loans, a unique financing option tailored for vintage enthusiasts. This article explores how you can access fast cash with fast approval, making it an attractive solution for funding restoration projects or unexpected expenses. We delve into the benefits and considerations, providing insights for informed decision-making. Unleash your passion for classics while securing financial support today.

- Unlocking Funds: Title Loans for Classic Cars

- Fast Cash Approval: How It Works

- Benefits and Considerations for Car Owners

Unlocking Funds: Title Loans for Classic Cars

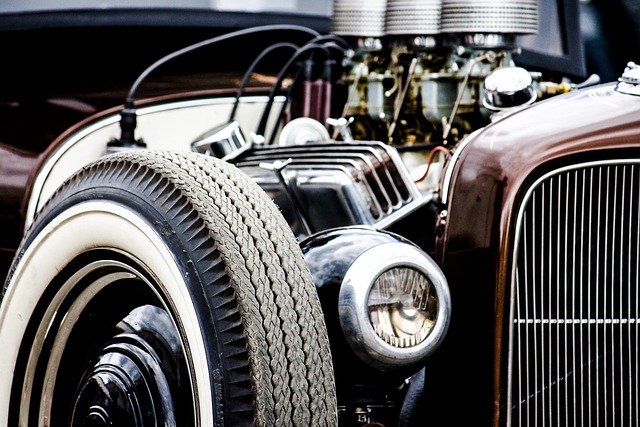

Classic car enthusiasts often face a challenge when it comes to funding their passion—but what if there was a way to unlock immediate financial support for these beloved vehicles? Enter Title Loans for Classic Cars, a game-changer in the automotive financing world. This innovative solution allows owners to leverage the value of their vintage rides and gain access to much-needed funds.

Imagine securing a loan using your classic car’s title as collateral. It’s a straightforward process where you can borrow against the vehicle’s appraised value. Whether you’re in Houston, San Antonio, or beyond, this option provides a quick and efficient way to obtain cash. The beauty lies in its accessibility; even if you have less-than-perfect credit, a title loan can be approved based on your car’s condition and market value. So, for those dreaming of restoring their classic or funding that special purchase, consider Title Loans as a convenient and effective solution, potentially enabling you to pay off loans swiftly and focus on what matters most—the joy of driving your dream car.

Fast Cash Approval: How It Works

When it comes to securing fast cash for your classic car, a Car Title Loan is an excellent option. The process starts with an Online Application, where you provide details about your vehicle and financial information. Once submitted, lenders will thoroughly review your application to ensure accuracy and eligibility. If approved, the lender will evaluate your classic car’s value, taking into account its make, model, year, and overall condition.

After a successful assessment, you’ll receive Fast Cash—a significant advantage of Car Title Loans. This quick approval is possible because the loan is secured by your vehicle’s title, allowing lenders to process transactions swiftly. With a simple and efficient online application process, getting cash for your beloved classic car has never been easier.

Benefits and Considerations for Car Owners

For classic car owners, a Title Loan for Classic Cars can offer a unique opportunity to access financial assistance for various needs. This alternative financing method allows individuals to leverage the value of their vintage vehicles without having to part with them. One significant advantage is that it provides a quick and efficient way to secure funds, which can be particularly appealing to car enthusiasts who may require urgent capital for repairs, restoration projects, or even daily expenses.

When considering a title loan, car owners should weigh the benefits against potential drawbacks. While it offers a simple application process without credit checks, the interest rates can be higher than traditional loans. Additionally, failing to repay the loan on time could result in additional fees and even vehicle repossession. However, for those who manage their finances responsibly, this option can serve as a practical solution, ensuring that the love for classic cars doesn’t have to come at the cost of financial stability.

A title loan for classic cars offers car owners a unique opportunity to access fast cash while maintaining their prized possession. With Fast Cash Approval, this process is streamlined, providing a convenient solution for those in need of immediate financial support. While there are benefits such as quick funding and flexible repayment terms, it’s essential to carefully consider the terms and conditions to ensure a positive borrowing experience. By understanding both the advantages and potential drawbacks, classic car owners can make informed decisions, unlocking much-needed funds without compromising their beloved vehicles.